how to cash out crypto without paying taxes canada

For the savvy taxpayer there is a legal way to reduce taxes to zero on thousands of crypto profits. Do you pay tax when you buy crypto in Canada.

How To Cash Out Bitcoin Without Paying Taxes 5 Tips

How is cryptocurrency taxed in Canada.

.png)

. Taxes in and of themselves can be complex and throwing your crypto gains on top of it makes things even more challenging. No but also sometimes yes. Cryptocurrency is taxed like any other commodity in Canada.

The solution to the crypto tax problem hinges on aggregating all of your cryptocurrency data that makes up your buys sells trades airdrops forks mined coins exchanges swaps and received cryptocurrencies into one platform so that you can build out an accurate tax profile containing all of your transaction data. Report the resulting gain or loss as either business income or loss or a capital gain or loss. The buy-and-hold strategy is simple.

21 Mei 2021 -. If you live in a jurisdiction that requires you to pay tax on cryptocurrencies there may still be a way of avoiding the tax man namely. To move Bitcoins to your bank and thus convert them into Canadian dollars via direct deposit the flat rate is 25 and can take up to two business days.

Posted by May 20 2021 May 20 2021. Check out Benzingas guide to cashing out Bitcoin without paying or minimizing your taxes and connect with our expert Bitcoin investment and tax preparation partners. If you buy cryptocurrency inside of a traditional IRA you will defer tax on the gains until you begin to take distributions.

Buying crypto with fiat currency. Httpscanadiantaxbitcoin-tax Realization of capital gains occurs when you exchange your property for cash or other property that is valued greater than your cost. And sure as long as you hold it as crypto your gains will not be visible but your initial deposits to the exchanges are visible and you are now in the list of Canadians who are into crypto so if in a few years the CRA sees that youre not declaring anything related to crypto yet youre still in their list of depositors on exchanges they might start to wonder why you still havent reported.

Guide to Bitcoin Crypto Taxes in Canada Updated 2020. Fees vary for converting to cryptocurrencies but transactions are instant. 50 of the gains are taxable and added to your income for that year.

Uncategorized how to cash out crypto without paying taxes canada. We cover how to calculate your taxes how to minimize your capital gains and what is required to be reported by the Canada Revenue Agency. Invest in tax-free gold with digital tokens Buy cryptocurrency in your ROTH IRA Purchase an international PPLI Move to a tax-free country Give up US citizenship Tip 1 Invest In Tax-Free Gold With Bitcoin.

True gifts may not trigger any income taxes but there could be gift taxes involved. The following chart shows you a summary of these three variables and how you can qualify for the zero percent crypto tax rate. Another way to cash out bitcoin in Canada is to spend it on websites such as Newegg or Overstock.

These websites accept several cryptocurrencies as payment including bitcoin Ethereum Dogecoin and Litecoin. What Tether offers primarily is a safeguard against crypto-world volatility without having to deal with FIAT exchanges randomly holding your money for weeks or months at a time of which you can find many horror stories on Reddit even for people with KYC verification in place. How to cash out bitcoins without paying taxes canada.

If it was held for a year or longer then long-term capital gains tax rates apply On the other hand if the investor sells their crypto after holding it for less than a year then short-term rates apply. How to Cash Out Crypto Without Paying Taxes Written By Morisset Yestanters Friday November 26 2021 Add Comment Edit. Spend Crypto In Canada.

How to pay no taxes on your Bitcoin gains. This transaction is considered a disposition and you have to report it on your income tax return. Moving crypto between your own wallets.

In this guide you will learn everything you need to know about bitcoin and cryptocurrency taxation in Canada. Lets say you bought a cryptocurrency for 1000 and sold it later for 3000. These gains will be reported on Form 8949 and.

Remember that buying anything with crypto could incur capital gains tax. Posted at 2301h in Uncategorized by 0 Comments. This includes crypto-to-crypto exchanges.

The longer an investor holds on to their crypto the lower their potential tax bill when they do eventually exchange it for cash. Business income or loss. Posted on May 21 2021 by May 21 2021 by.

The easiest way to defer or eliminate tax on your cryptocurrency investments is to buy inside of an IRA 401-k defined benefit or other retirement plans. Donating crypto to charity. Go to Ndaxios website Bitcoin ATMs A Bitcoin ATM is the most convenient way to cash out your Bitcoins.

If you give crypto to a friend or family memberto anyone reallyask how much it is worth. Home Uncategorized how to cash out crypto without paying taxes canada. You will also learn how to generate.

You wont pay tax on crypto when youre. You have to convert the value of the cryptocurrency you received into Canadian dollars. How to cash out crypto without paying taxes canada.

Guest Post US. There are some specific crypto transactions that are tax free in Canada. Based on the tax consultants suggestions you may wish to periodically withdraw the amount from cryptocurrency to fiat currency so that when tax season comes you have the money set aside to pay your taxes.

The very reason cryptocurrency was created was to avoid government control and Corruption. You would have to report a capital gain of 1000 50 of 2000 which would be added to your income and taxed at your. The eligibility for this 0 tax rate depends on your filing status annual income you make and how long you kept the cryptocurrency before selling it.

How to cash out crypto without paying taxes canada.

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

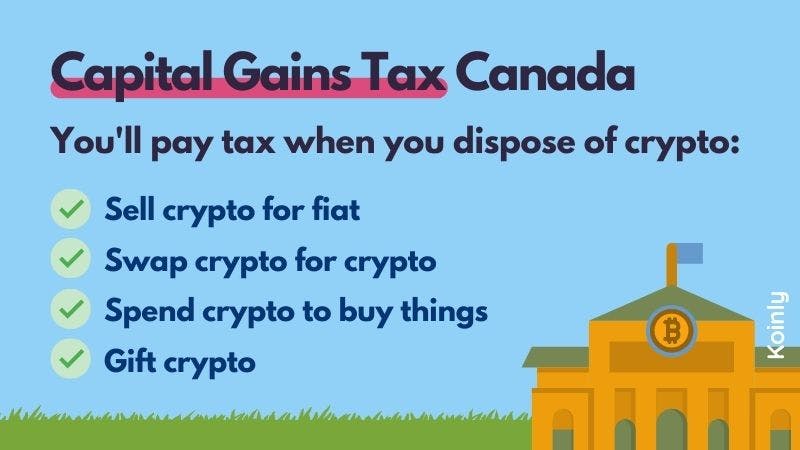

Crypto Tax Canada Ultimate Guide 2022 Koinly

Paying Taxes On Crypto In Canada Pay Only When You Cash Out R Cryptocurrency

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

Crypto Tax Canada Ultimate Guide 2022 Koinly

.png)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

0 Response to "how to cash out crypto without paying taxes canada"

Post a Comment